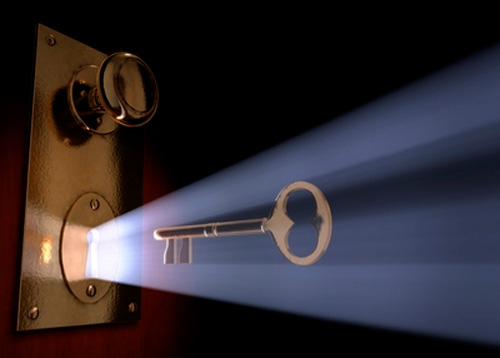

Consulting for equity has revolutionized the way businesses access high-level expertise without the upfront costs of traditional consulting services. In this model, consultants receive a stake in the business in exchange for their strategic input, creating a win-win relationship. Here’s how this approach can unlock exponential growth for your business.

1. What is Consulting for Equity?

Consulting for equity involves partnering with an expert or consulting firm that takes an equity stake in your business in lieu of a hefty consulting fee. This approach aligns the consultant’s interests with yours because their success is tied to your company’s performance. As a result, the consultant is incentivized to go the extra mile to ensure long-term growth, rather than providing short-term fixes.

2. Unlocking High-Level Expertise

One of the biggest challenges for growing businesses is the ability to access seasoned expertise without draining cash reserves. Consultants with a proven track record often come with a high price tag, making it difficult for smaller businesses to tap into their knowledge. Consulting for equity removes that barrier, allowing you to bring on board experts in marketing, operations, finance, or strategy who will help you drive your business forward.

3. Long-Term Value Creation

Traditional consultants are often focused on delivering quick wins or short-term strategies. In contrast, an equity consultant becomes a long-term partner who is invested in the future of your business. Their focus is on creating sustainable, scalable solutions that will continue to generate value long after the consultancy ends.

For example, instead of simply advising on a marketing campaign, an equity consultant may work with you to overhaul your entire customer acquisition strategy, ensuring that it’s built to scale as your business grows.

4. How to Choose the Right Equity Consultant

Not all consultants are created equal. When looking for an equity partner, consider:

- Expertise: Does the consultant have a deep understanding of your industry and the specific challenges you face?

- Track Record: Have they helped other businesses scale? Can they provide case studies or testimonials?

- Cultural Fit: This is a partnership, not a transaction. Ensure the consultant’s working style aligns with your team and company culture.

- Equity Terms: Negotiate equity terms that work for both parties. You want to ensure that you’re providing a fair stake while still retaining control over your business.

5. Measuring Success in an Equity Partnership

With the consultant as a partner, you’ll want to establish clear goals and KPIs from the outset. This ensures both parties are aligned on what success looks like. Some common KPIs might include:

- Revenue growth

- Increased customer acquisition

- Improved operational efficiency

- Successful entry into new markets

By focusing on long-term growth and measurable success, consulting for equity can be the catalyst your business needs to scale without risking cash flow.